The Pretus newsletter is delivered - direct to YOU, every week.

12.25.2025

Keep reading for a quick, no-fluff look at what moved this week in IB recruiting.

Merry Christmas and Happy Holidays from the Pretus team!!🎄

Holiday Thank You 🎁

As a thank you for being part of the Pretus community, we are running 25% off your first month of Pretus Premium for this week only.

If Pretus has been helpful in your recruiting prep, this is our way of giving back during the holidays.

Recruitment Breakdown ✏️

Summer Analysts 2027: Applications continue to open…

New / Recently Opened SA27 Applications:

Citi (Bulge Bracket, SA 2027)

Jefferies (Middle Market, SA 2027)

Qatalyst Partners (Tech Boutique, SA 2027)

Lazard (Elite Boutique, SA 2027)

FT Partners (Fintech Boutique, SA 2027)

BNP Paribas (Large Global Bank, SA 2027)

Truist (Middle Market, Energy, SA 2027)

If you are waiting on one more firm before applying, this is the stretch where most candidates fall behind. Apply early where possible.

A couple of banks that also recently opened, in case you missed them:

Piper Sandler, Deloitte, Rothschild & Co. (EB), Deutsche Bank (MM), Moelis (EB), Houlihan Lokey (MM) 🔥 Apply ASAP to boost your chances ⚡

SA27 Live Applications: Perella Weinberg, Stifel, LionTree, Leerink Partners, RBC applications have been rolling…

Wishing you an inbox full of interview invites this December 🎁

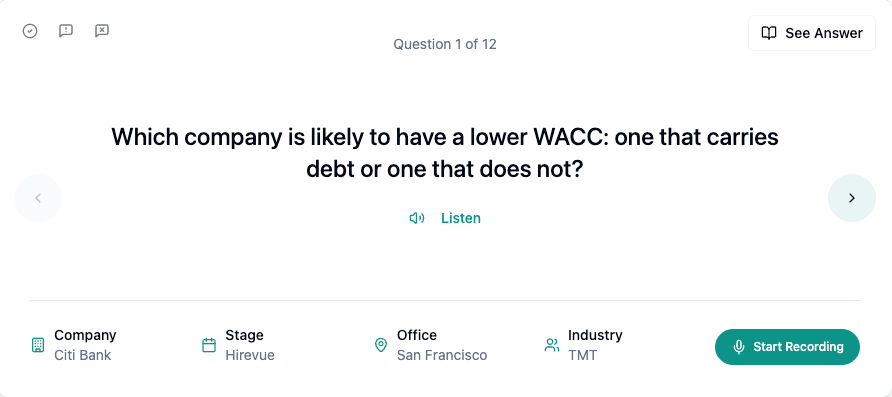

Question of the Week - Citibank

Each week, we break down one real recruiting or technical question from a bank with an open application, pulled from the Pretus flashcard Question Bank.

Question from Citi SF HireVue

All else equal, a company that uses some debt will typically have a lower WACC. Debt is cheaper than equity because it has priority in the capital structure and interest is tax-deductible, creating a tax shield. Introducing reasonable leverage lowers the overall weighted cost of capital until financial risk starts to outweigh the benefits.

This is a classic question where interviewers are testing whether you understand why capital structure matters, not just the formula.

Industry Headlines 📣

News worth knowing - More deal and market news coming next week

Private Credit Keeps Eating Share From Banks

Private credit firms continue to take share from traditional banks, especially in middle-market and sponsor-backed deals. With higher rates sticking around, direct lenders are offering faster execution and more flexible structures, even if pricing is higher.

Banks are still winning larger marquee transactions, but more sponsors are defaulting to private credit for speed and certainty. This trend is reshaping deal teams, capital structures, and exit dynamics.

Bottom line: Private credit is no longer a niche. Understanding how it competes with banks is increasingly a fair game in interviews.

New: Pretus Community 🧑🧑🧒🧒

We’re launching a free, active community for anyone going through investment banking recruiting. Think of it as an always available extension of your finance club that you can use anytime.

Inside, you can:

Ask recruiting questions and get real answers from one of our 10+ mentors and students who received offers at top banks

Join office hours with students who landed top banking offers

Access our deadline trackers

Get free resume reviews and recruiting resources

Stay up to date with recent banking and recruiting news that actually matters

Get early access to new banking questions and prep materials

We’re launching soon. Join the waitlist here:

Want a structured guide to IB recruiting? 📘

We recently started working with the team at Banking Playbook and wanted to share their recruiting guide with you. Their team of former bankers put together a 248-page deck covering recruiting timelines, technicals, networking, and interviews.

It is a solid complement to Pretus if you want a clear, end-to-end view of how the investment banking recruiting process fits together.

You can access their free teaser here.